Filling out a 2-NDFL certificate for a foreigner

This document will be required in cases where it becomes necessary to sign an employment agreement between a company, an organization, on the one hand, and an individual, on the other.

Dear Readers! The article talks about typical ways of solving legal issues, but each case is individual. If you want to know how solve your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

It's fast and IS FREE!

There are general rules and procedures for entering information. If we are talking about an employee who does not have Russian citizenship, the algorithm for filling out the form has certain specifics, which should be considered in more detail.

Norms of the law

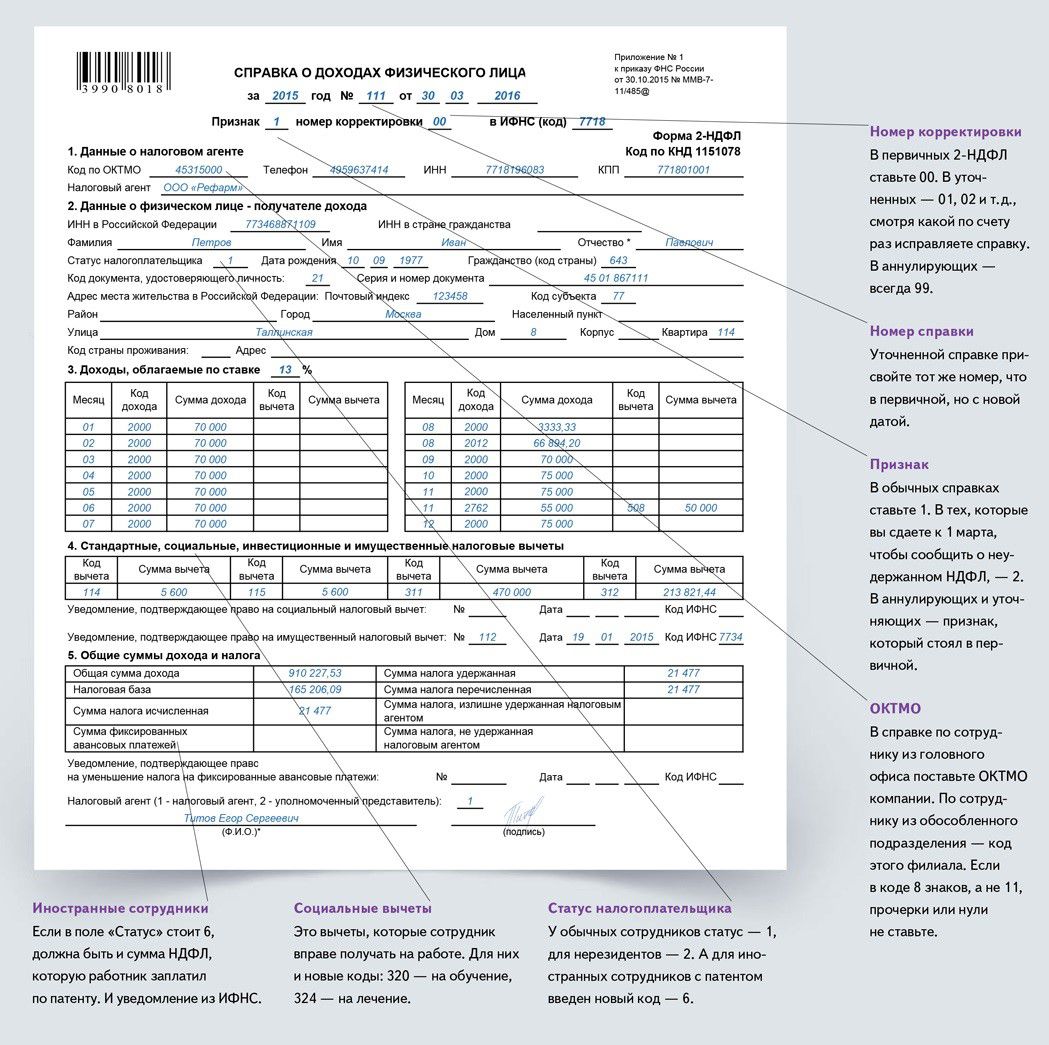

A sample 2-NDFL certificate for a foreigner who has arrived in Russia and plans to carry out labor activities on its territory is regulated by the current Order of the Federal Tax Service of October 30, 2015.

The document reflects information about both the employee and the employer. Within the framework of regulatory and legal acts, all migrants working in enterprises in the country must have a special permitting patent.

The procedure for calculating income, deductions, premiums and deductions, information about which is also indicated in the certificate, is approved by the Tax Code of the Russian Federation - in particular,.

What is it for?

This certificate is needed both by the executive state bodies and the employee himself.

In the first case, it is the replenishment of the information base on income taxation, withheld from the worker for a specific period of time.

The need of an individual is an order of magnitude higher, you cannot do without a document, if necessary:

- confirm your credit solvency;

- to receive an annual tax deduction;

- to participate in litigation, filing claims, arbitration disputes and proceedings;

- when changing the place of work;

- when applying for a residence permit and obtaining a Russian passport by a foreigner as a resident.

What income do you include?

There is no definite answer to this question. In each case, there may be different categories of income and deductions.

You need to fill in only those of the specified items that relate to the financial turnover of this employee.

It can be:

- official wages;

- additional income - from authorship, innovation, publications;

- any activities payable;

- financial contributions with an indication of the currency equivalent;

- promotional profits;

- insurance charges;

- buybacks;

- rental income;

- profit from the sale of goods or products;

- maternity, pension, vacation pay and hospital charges.

From all of the above, the compiler chooses what is relevant to him and gives the appropriate information.

Registration of a 2-NDFL certificate for a foreign citizen in 2019

Since 2019, the form has undergone changes in the lines related to citizenship. So, in the second section of the document, a place appeared for indicating the TIN of the country from which the employee came.

The same list of legal statuses of persons transferring taxes has increased, and new items have appeared:

- workers, qualified as migrants, who left their homeland on a voluntary basis, while being compatriots;

- persons considered refugees;

- employees of other states carrying out labor activities under the patent.

Compilation procedure

This certificate must be drawn up by all managers who have employees.

Served in paper or electronic form, if there are more than 10 staff units - only in electronic form.

All information is drawn from the tax register for personal income tax accounting. Financial indicators are shown in ruble terms. The pennies are rounded.

Section 1

Reflects all data about a tax agent. The head indicates the last name, first name, patronymic (without abbreviations), in the same way as it is written in the passport, personal tax number, OKATO, work and mobile phone.

If there are no contacts, this line is not filled.

Section 2

All information concerning an individual is registered here.

In the column where the TIN number should be written, it means registration with the tax service of the Russian Federation. If it is not there, the deadline remains empty - no notes are made.

Personal passport data are written in Latin block letters, as indicated in the employee's identity document.

The "status" field is drawn up according to the table.

Date of birth is filled in with Arabic numerals. In the column on the availability of citizenship, a code is written, consisting of several numbers. The complete list of codes is regulated by the unified world classifier of countries.

The lines about the place of residence, the subject of the federation, and other information that is not related to persons who have arrived from abroad should be left blank.

Section 3

To correctly fill out this section, you need to use the table of accepted code designations of income and expense items.

The main requirement is to do everything as correctly as possible.

For example, citizen Petrov had a prize for good work. Such payments are assigned the code "2000" (similar to the wage cipher). If the basis for the bonus is a festive event, then this is already a different, "4800" code, since such an incentive is classified in the accounting tax document circulation as other income. Separate codes are not allocated for them.

At the top of the section, the size of the base tax rate is mandatory - in this case, it is 30%.

Section 4

Contains information about all tax deductions that have taken place from a foreign employee.

A specific reporting period is taken as a basis. The filling principle is the same system of codes as in the previous section (taken from the classifier).

Column "notification" - reflects the data of the relevant paper that the employee received from the migration service, which legally enshrines his right to provide an annual tax deduction of medical, social or property orientation.

Section 5

For a foreigner, this section is completed in a standard manner.

If the indicator is more than the amount of the declared personal income tax, then in the next two lines for withheld and paid fees to the state budget, you need to put zeros.

The term “tax base” refers to the amount remaining after deductions for all accrued income. Moreover, for a foreign citizen on the patent, it is necessary to separately indicate the amount of advance charges.

Sample filling

Sample filling 2 - personal income tax for a foreign citizen can be viewed at the link.

Previously, a separate form would be filled in for each employee, now everything can be filled out in one certificate.

Let's consider the main nuances and specifics of submitting information, depending on the legal circumstances.

Peculiarities

How to fill out the form, taking into account the legal status of residence of a stateless person? Depending on the basis on which a person lives and works in Russia, the specifics of paperwork depends.

On the patent

The only distinguishing feature when filling out a 2-personal income tax certificate for persons without a Russian passport who have a patent for work is the indication of the taxpayer status code of category "6".

All other fields are filled in in the general order.

With RVP

If the company employs a person who has a temporary residence permit, in the column "document code" confirming the identity of the employee, code 15 should be indicated. It reflects the status of the resident.

The serial number of the permit for temporary residence in the territory of the Russian Federation is not written in full - only its digital abbreviation is indicated. You do not need to write alphabetic characters.

With a residence permit

According to Articles 3 and 10 of the Federal Law, a residence permit is a status confirming the legal right of a person to be within the territorial boundaries of the country, as well as to enter and leave the Russian Federation at his own discretion.

However, this document cannot serve as a confirmation of the identity of a person who does not have Russian citizenship.